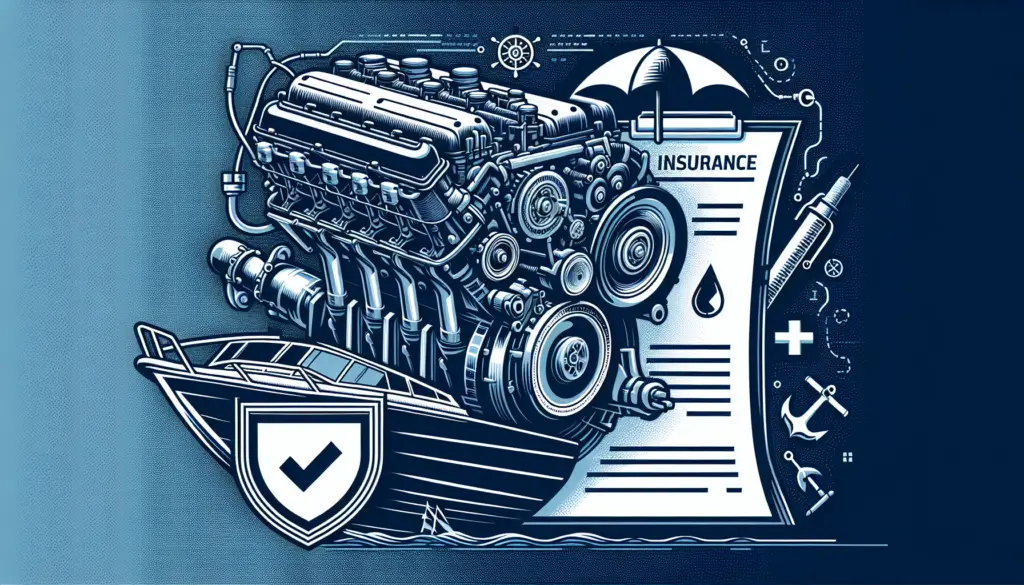

Imagine you’ve just invested a significant amount of your hard-earned money into the boat of your dreams. The open sea calls, the wind is always perfect, and you can’t wait to make lasting memories with your family and friends. But wait, there’s one crucial thing you may have overlooked — boat engine insurance. In this article, you’ll discover some top tips for ensuring your boat engine, a crucial step in safeguarding your treasured investment. So, let’s get started on making sure you have smooth sailing ahead!

Understanding the Importance of Boat Engine Insurance

Let’s get real, owning a boat is a substantial financial commitment. Like any valuable asset, you want to protect your investment. And believe it or not, boat engine insurance is a central aspect of that protection.

Recognizing the Potential Cost of Repairs

Imagine this: You’re out on the open water, the sun is shining, the waves are gentle, and suddenly, your boat engine fails. You’re stuck. After some tinkering and troubleshooting, you realize the issue is beyond your expertise. The potential cost of these repairs can skyrocket quickly, particularly if you’re dealing with high-end marine motors. This is where boat engine insurance comes into play.

Assessing the Risks Involved in Boating

Boating is not a risk-free activity. Rough weather, inexperienced boaters, and underwater obstacles are aspects of typical boating environments. These factors can lead to incidents that may damage your boat’s engine. Having comprehensive insurance buttresses the costs associated with these unforeseeable incidents.

Understanding the Financial Protection Offered by Insurance

More than anything, boat engine insurance provides financial protection. It covers repair or replacement costs of your boat’s engine in the event of damage or if it’s stolen. It also offers liability coverage if, God forbid, your boat causes harm to a third party.

Choosing the Right Boat Engine Insurance Policy

Not all boat engine insurance policies are created equal. It’s crucial to select a policy that suits your needs best.

Identifying Your Unique Needs

Every boat owner has unique needs that depend on factors like the type of boat, its usage, location, and your budget. Understanding your needs acts as a foundation for finding the appropriate policy.

Comparing Different Insurance Providers

The insurance market is filled with various providers, each offering distinct policies. Taking time to compare their offers helps you to identify providers that offer the most suitable options.

Evaluating Coverage Options

Understanding the coverage options each policy offers is pivotal. Coverage options can range from comprehensive, covering all risks, to more specific options like named perils policies that only cover risks specified in the policy.

Considering Additional Coverage

Depending on the extent of your boating activities, you might need additional coverage. Options like fuel spill liability, uninsured boater coverage, or roadside assistance make for comprehensive protection.

Ensuring Adequate Coverage for the Type of Boat

The type of boat you own influences the level and kind of coverage needed significantly.

Understanding Different Types of Boat

Boats range from small fishing boats and pontoons to large yachts. Each boat type has unique characteristics that affect their insurance needs.

Identifying Suitable Boat Engine Insurance Policies for Each Type

Every boat requires a specific policy. For instance, a high-performance speedboat needs different coverage compared to a casual pontoon boat. Understanding this ensures that you are adequately covered.

Consequences of Insufficient Coverage

Having insufficient coverage could lead to large out-of-pocket expenses in case of an incident. Always err on the side of having more coverage than less.

Considering the Age and Value of the Boat

The value and age of your boat play a big role in determining your insurance premium.

Impact of Boat’s Age and Value on Insurance Premium

Generally, higher-valued and older boats carry a higher insurance premium because of the potential cost of repairs or replacements.

Choosing Between Actual Cash Value and Agreed Value Policies

Considering your boat’s value and age, you might need to decide between actual cash value and agreed value policies. Agreed value pays the amount agreed upon at the start of the policy, while actual cash value considers depreciation.

The Relevance of Depreciation in Boat Engine Insurance

Depreciation is relevant as it lowers the payout you’ll receive in case of a total loss.

Understanding the Role of Boat Usage in Insurance

How you use your boat will affect your insurance needs.

Differentiating Between Personal and Commercial Use

Personal use is typically covered under standard policies. However, if you use your boat for commercial purposes, you’ll need additional coverage.

Implications of Boat Use on Insurance Rates

Generally, commercial usage may increase the insurance rate because of the increased risk associated.

Necessary Coverage for Various Boat Activities

For example, if you participate in water sports, you might need additional coverage for potential injuries or damages.

Factoring in Location and Storage of the Boat

Where you keep and use your boat also impacts your insurance.

Importance of Geographical Area in Calculating Insurance Cost

Some geographical areas carry more risk than others due to factors like weather, theft, and water conditions.

Impact of Storage Method on Insurance Premium

Keeping your boat in a secured storage facility can reduce premium costs compared to a public dock.

Securing Coverage for Transportation Risks

If you regularly transport your boat, you should consider a policy covering transportation risks.

Evaluating the Impact of Boating Experience and Courses on Insurance

A seasoned boater is seen as a lower risk, which can impact your insurance premium.

Benefiting from Safety Courses and Certificates

Completing boating safety courses can earn you a discount on your insurance.

Experience-Based Discounts in Insurance

An experienced boater can enjoy lower premium costs due to a reduced risk perception.

Role of Boating History in Insurance Pricing

If you have a clean boating history, you’re likely to enjoy lower premiums.

Understanding the Claims Process

Knowing the procedure for claims is vital in case of an incident.

Requirement for Making an Insurance Claim

Most insurers require immediate notification after an insurance event.

Documenting and Reporting Damages

Proper documentation and reporting of damages can streamline your claims process.

Dealing with Insurance Adjusters

Understanding how to deal with adjusters helps you get the maximum out from your claim.

Maintaining the Boat Engine for Lower Insurance Premiums

Routine maintenance of your boat engine can impact insurance costs.

Benefits of Regular Maintenance on Insurance Cost

Regular maintenance reduces the risk of breakdown, which can lower your premium.

Impact of Engine Modifications on Insurance

Significant engine modifications could increase your premiums due to increased values or performance levels.

The Role of Maintenance Records in Insurance Claims

Keeping maintenance records can make your insurance claims process smoother.

Tips to Save on Boat Engine Insurance

A few smart decisions can help you save on boat engine insurance.

Adjusting Deductibles for Lower Premiums

Increasing your deductibles can lead to lower premiums.

Leveraging Insurance Bundles and Discounts

Bundling your insurance or taking advantage of discounts can lead to substantial savings.

Maintaining a Clean Boating Record

A clean boating record positions you as a low-risk policyholder, resulting in lower insurance costs.

In conclusion, taking care of your boat involves understanding the intricacies of boat engine insurance. An appropriate policy will save you money in the long run and provide serene peace of mind while exploring the open waters. Happy boating!