You’ve worked hard for that beautiful boat of yours. The open water, the freedom, the adventure – it’s all worth safeguarding. “Top Boat Engine Insurance Tips for Protecting Your Investment” gives you the scoop on how to secure the best insurance for your boat engine, ensuring your prized possession is protected no matter what may hit your way. This article is like a lighthouse guiding you through the murky decision-making process, making it a smooth and enjoyable journey.

Understanding the Basics of Boat Engine Insurance

Before you set sail, it’s important to understand the basics of boat engine insurance. Boat engine insurance provides financial protection against unforeseen damages or loss to your boat’s engine. It’s a crucial part of being a responsible boat owner, assuring that you can handle any financial setbacks related to your engine.

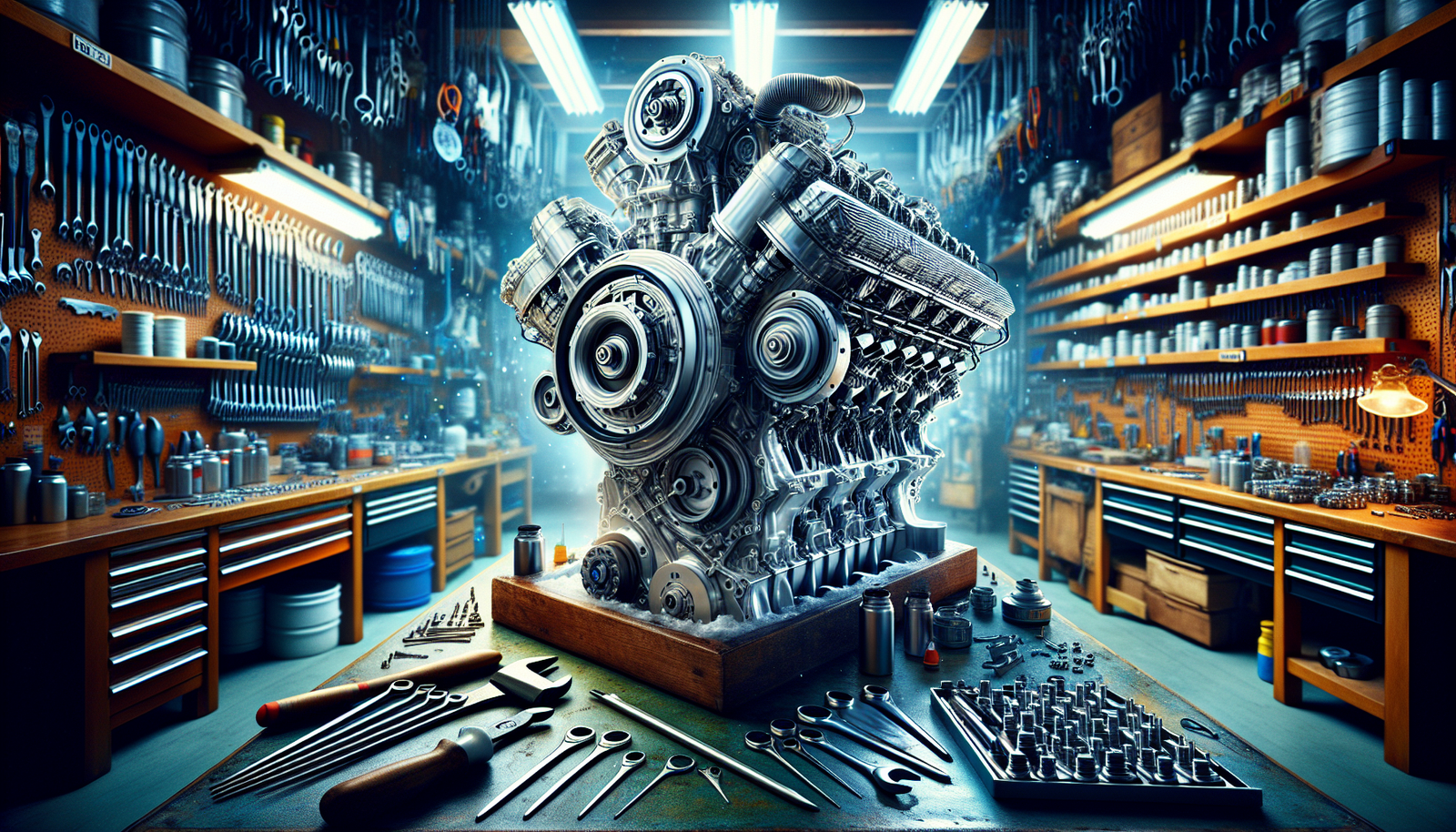

Importance of Engine Insurance

Engine insurance isn’t just a formality; it holds significant importance. The engine is the heart of the boat, often one of the most expensive components. Repairing or replacing an engine can cost thousands, if not tens of thousands of dollars. With engine insurance, you can mitigates these risks, providing financial peace of mind.

Different Types of Boat Engine Insurance

Boat engine insurance comes in various forms. For instance, there’s ‘Actual Cash Value’ where the insurer pays the value of the damaged property at the time of the damage, less deductible. There’s replacement cost coverage where the insurer pays the cost to repair or replace the engine without a deduction for depreciation. Your choice depends on your needs, budget, and peace of mind you’re seeking.

General Coverage Provided by Engine Insurance

In general, a boat engine insurance policy covers the cost of repairs or replacement if your engine is damaged due to an insured event such as a fire, storm, theft, or accident. Note that these coverage elements vary based on policy type and insurance provider.

Choosing the Right Boat Engine Insurance Policy

Selecting the appropriate boat engine insurance policy requires careful consideration. You don’t want to end up over-insured with high premiums or under-insured with inadequate coverage.

Key Aspects to Consider When Choosing a Policy

When selecting an insurance policy, consider factors like the age and type of your boat, the type of engine, and the waters where you’ll be boating. The policy should cover common risks in your boating area, and align with your budget without compromising on essential coverage elements.

Comparing Different Insurance Providers

Comparison is key in choosing a policy. Different providers offer different deals, with variations in costs, coverage, and customer service. Look at reviews, request quotes, and consider the reputation of the companies before making a decision.

Reading and Understanding the Fine Print

Insurance policies are known for their complex language. Hence, it’s essential to read and understand everything before signing. Check what’s covered, what’s not, the deductibles, the exclusions, and the claims process to avoid surprises later.

The Role of Boat Usage in Insurance

Your boating habits significantly impact your insurance needs.

Impact of Boat’s Purpose on Insurance (Pleasure, Commercial, etc.)

The insurance for a boat used for commercial purposes like fishing or ferrying passengers might differ from a pleasure craft. Generally, commercial use entails more hazards, thus might require comprehensive coverage with higher premiums.

How Boat Location Affects Insurance Premiums

Your location, both where you boat and where you store your boat, affects your premiums. Areas prone to extreme weather conditions or high theft rates might lead to higher insurance costs.

Effects of Boat Usage Frequency on Insurance Policy

How frequently you use your boat might also impact your policy. If you’re an occasional sailor, ‘Lay-up’ periods, where the policy is put on hold while the boat is not in use, can be a cost-effective option.

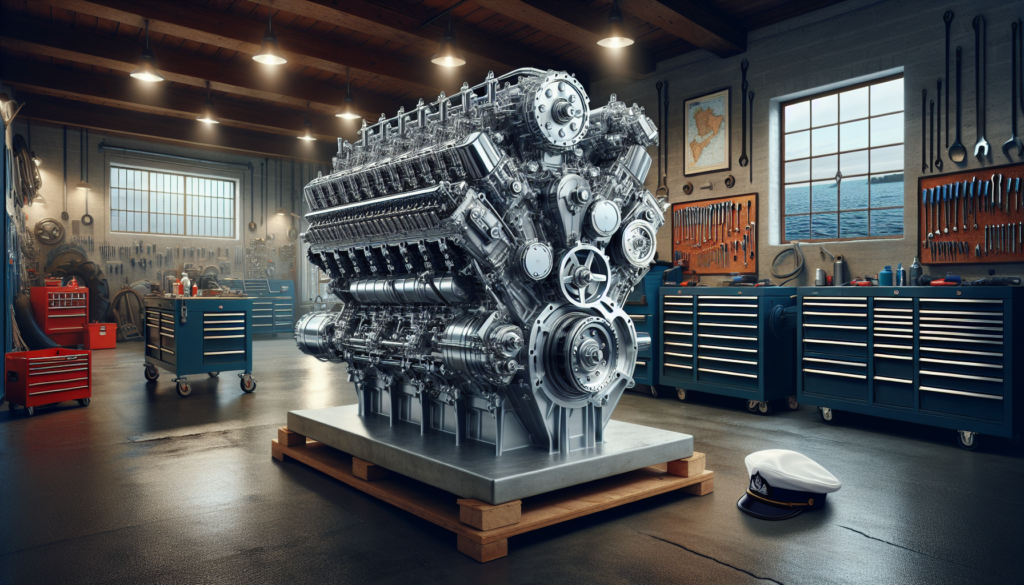

Insurance for Different Types of Boat Engines

Insurance needs also vary as per your engine type.

Insurance for Outboard Engines

Outboard engines, being portable and easier to steal, might need additional coverage. An insurance that covers theft or offers the replacement cost can be beneficial.

Insurance for Inboard Engines

Inboard engines, integrated into the boat’s structure, are subject to risks like sinking, fire, or collision. An insurance policy encompassing these risks might be required.

How Engine Type Affects Insurance Costs and Coverage

The type of engine not only influences risks and thus policy coverage, but also impacts cost since high-performance engines often mean higher premiums.

Dealing with Boat Engine Insurance Claims

Understanding the claims process before you need to make a claim is crucial.

Steps to Follow When Filing an Insurance Claim

If you need to file a claim, report the incident to your insurer immediately. Document the damage with photos or videos, gather any witness statements, and keep repair bills or replacement receipts.

Understanding Your Insurance Company’s Claim Process

Every company has its own claim procedure, thus being familiar with it can aid in a smooth claim process. Know your policy number, the claims contact, procedure, and turnaround time.

Ensuring Fair Payout from Insurance Claim

To ensure you receive a fair payout, keep a record of your boat’s maintenance and upgrades. This information will provide proof of your boat’s condition and its associated value at the time of the claim.

Preventive Measures for Minimizing Insurance Claims

Prevention is better than cure. Regular maintenance and safe practices can keep your boat in prime condition, reducing the chances of claims.

Routine Engine Maintenance and Safety Checks

Perform regular engine checks and maintenance. Fix minor issues before they escalate. Regular maintenance ensures your engine remains reliable and efficient, which can be a crucial factor during an insurance claim.

Safe Boating Practices

Safe boating practices like obeying boating rules, staying aware of the surroundings, and not operating the boat under influence reduce the risk of accidents.

Importance of Boat Storage and Winterization

Proper storage, especially during winter, reduces exposure to harmful elements. Winterization involves procedures like engine care, which protect the boat from extreme cold, while a secure storage facility protects against theft or vandalism.

Possible Discounts on Boat Engine Insurance

Insurance providers often offer discounts to responsible boat owners.

Common Discounts Offered by Insurance Companies

Some insurance companies provide discounts for factors like having multiple policies from the same company, being claims-free, or installing safety devices on your boat.

Qualifying for Multiple Policy Discounts

Holding multiple insurance policies from the same provider, say, your car, home, and boat insurance, can qualify you for a multi-policy discount.

Role of Boating Safety Courses in Obtaining Discounts

Completion of boating safety courses demonstrates your commitment to safe boating and can qualify you for discounts on your boat insurance.

The Importance of Boat Engine Valuation

A correct engine valuation ensures you don’t overpay or underinsure your boat.

Accurate Boat Engine Valuation for Insurance

The overall value of your boat, particularly the engine’s cost, impacts the cost of your insurance. Accurate valuation ensures you get the right coverage.

Role of a Marine Surveyor in Engine Valuation

A professional marine surveyor assesses your boat and provides a detailed report on its condition and value, which can be used for insurance purposes.

How Depreciation Affects Boat Engine Value

Boat engines, like any mechanical equipment, depreciate over time. Understanding how depreciation works can help you adjust your insurance needs and prevent over-insurance or under-insurance.

Boat Engine Insurance Coverage Limitations and Exclusions

Understanding your policy’s limitations and exclusions helps you know your cover’s boundaries.

Common Exclusions in Boat Engine Insurance

Typical exclusions in boat engine insurance include damages due to wear and tear, design defects, or damages occurring when the boat is being transported by land.

Understanding the Limitations of Your Policy

Each policy comes with limitations, either in terms of the maximum amount payable under the policy, or limitations on what is covered. Being aware of them helps align expectations.

How to Fill Gaps in Your Insurance Coverage

If you think the insurer doesn’t cover certain risks you’re exposed to, consider additional policies or riders to fill those gaps.

Regularly Reviewing and Updating Your Boat Engine Insurance

Like other insurance policies, boat engine insurance should be reviewed and updated regularly.

Importance of Reviewing Your Policy Regularly

Regular reviews help detect any gaps in coverage, check the competitiveness of your premium, and ensure the policy aligns with your current needs.

When and Why to Update Your Insurance

Significant changes to your boating habits, upgrades to the boat, or changes in local boating regulations are a few instances when you might need to update your policy to ensure it remains relevant.

The Effect of Recent Changes in Boating Laws/Regulations on Your Insurance Policy

Changes in boating laws or regulations might affect insurance requirements. Regular policy reviews and keeping abreast of local regulations ensures your compliance with laws and adequacy of your coverage.