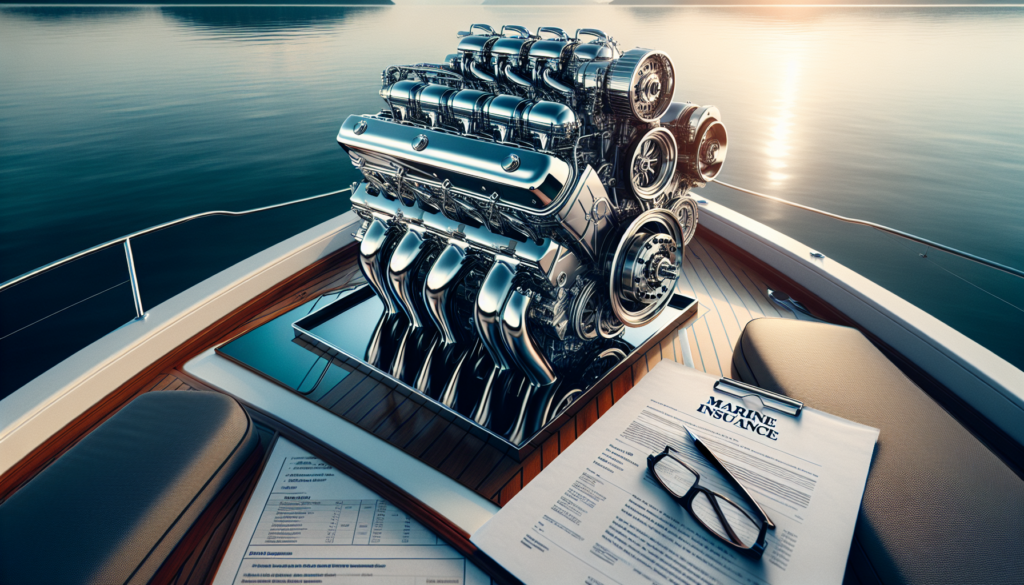

Just like your car or house, your boat also warrants protection, and the core of this protection lies not just in its hull, but in its engine. Your investment in a boat engine doesn’t stop at purchasing; maintaining it through insurance is critical in safeguarding it from damages or, in worst-case scenarios, total loss. This article, “Top Boat Engine Insurance Tips for Protecting Your Investment,” offers insights and tips to help you understand how to best protect this valuable asset to ensure its longevity and dependable performance.

Understanding Boat Engine Insurance

Boating is fun, and it’s a great way to connect with nature, enjoy time with family and friends, or find some peace and quiet on your own. But owning a boat also means taking care of a boat, and that includes understanding and protecting your investment with the right insurance policy.

Basics of boat engine insurance

Let’s begin with the basics of boat engine insurance. Just like insuring your car or house, boat engine insurance safeguards you against financial loss or liability if your engine gets damaged or stolen. It’s important to remember that the engine is often the most expensive part of the boat, hence the need to ensure its protection specifically.

Difference between boat insurance and boat engine insurance

“But wait,” you might say. “I’ve already got boat insurance. Isn’t that enough?” Not necessarily. Traditional boat insurance typically covers the boat as a whole against damage or loss. Boat engine insurance, on the other hand, offers specific coverage for the engine.

Choosing the Right Boat Insurance Policy

The right insurance policy can lay the foundation for many peaceful days out on the water, knowing that you’ve taken steps to protect your investment.

Coverage options

Every insurance policy offers different coverage options, and boat engine insurance is no exception. Some policies cover only certain types of damage or loss, while others offer more comprehensive coverage. Some might include coverage for personal property or for salvage and towing costs.

Boat usage and insurance

How you use your boat can significantly impact your insurance policy. Whether you sail bays on weekends, cruise open waters for months at a time, or race competitively, your usage will largely influence your policy, its premiums and its deductibles.

Understanding deductibles and premiums

Speaking of premiums and deductibles, let’s clarify what these are. The premium is the amount you pay for your insurance policy while the deductible is the amount you will pay out of pocket before insurance kicks in.

Evaluating Your Boat Engine’s Worth

Like any other valuable asset, determining the value of your boat engine is crucial.

Determining value of your boat engine

To determine the value of your boat’s engine, you might consider hiring a professional marine surveyor. This trained expert can assess the condition and value of your boat and engine, which can help you make informed decisions about your insurance.

Considerations for older boat engines

If your boat engine is older, you’ll face some added considerations. Older engines may be more likely to break down, which could mean higher insurance costs.

Negotiating engine value with insurance companies

Sometimes, you may need to negotiate with your insurance company about your engine’s value. If you disagree with their estimate, be prepared to show proof of your engine’s worth, such as maintenance records or a recent survey.

Navigating Natural Disaster Coverage

Nothing can spoil a beautiful day on the water quicker than a sudden storm.

Understanding natural disaster coverage

By understanding your natural disaster coverage, you will know what to expect in the event of a storm, flood, or earthquake. Most insurance policies cover damage or loss due to these incidents, but you should check your particular policy to be sure.

Extra coverage options for hurricane zones

If you live or boat in a hurricane zone, you might need extra coverage. Make sure to review this with your insurance agent and safeguard your boat appropriately.

Ensuring Proper Maintenance for Insurance

Preserving the longevity of your boat engine means following consistent maintenance schedules and adopting best practices.

How regular maintenance impacts insurance

Insurance companies value well-maintained engines—much like how health insurance companies value healthy lifestyles. Regular maintenance could lower your premiums and demonstrate your commitment to protecting your investment.

Proper documentation of maintenance

Always document your engine’s maintenance to provide to your insurance company, if needed. These records can demonstrate your boat’s worth and could potentially influence your premiums.

Handling repair and replacements under insurance

How you handle repairs or replacements can also impact your insurance policy. For instance, if a repair is needed due to an accident, you may need to inform your insurance company before the work is done to ensure the costs are covered.

Boating Safety and Insurance Rates

Safe boating practices are not only important for you and your passengers’ safety, but they can also affect your insurance rates.

Impact of safety gear on insurance

Having required or extra safety gear on board—such as flotation devices, fire extinguishers, or navigation lights—can influence your insurance premiums and demonstrate you are a responsible boater.

Understanding discounts for safety courses

Many insurance companies offer discounts for boaters who have completed approved safety courses. This is a good way to lower your premiums and improve your knowledge and skills on the water.

Effect of boat driving record on insurance rates

Just like with car insurance, your boating record can have a significant effect on your insurance rates. A clear record indicates a lower risk to the insurance company, which could lead to lower premiums.

Dealing with Boat Engine Theft and Insurance

Nothing can ruin a day like discovering your boat engine has been stolen.

Preventing engine theft

Preventing boat engine theft can be as simple as locking your engine, storing your boat securely when it’s not in use, or installing a tracking system.

Ensuring proper theft coverage

Make sure your insurance policy covers engine theft. If it doesn’t, consider adding extra coverage.

Reporting theft to insurance and authorities

If, unfortunately, your engine is stolen, immediately report the theft to your insurance company and local authorities.

Common Exclusions in Boat Engine Insurance

It’s essential to note that not all situations are covered by boat engine insurance.

Wear and tear

Typically, insurance does not cover normal wear and tear. This means everyday use or gradual deterioration isn’t usually covered by your policy.

Manufacturer defects

Manufacturer defects are usually covered by warranties, not insurance. If your engine is brand new, this is something to look into.

Damage from uninsurable risks

Uninsurable risks, such as acts of war, are not usually covered by insurance policies.

Filing Boat Engine Insurance Claim

If something does happen to your engine, you’ll want to file an insurance claim.

Steps for filing a successful claim

When filing a claim, always provide complete information and document everything. Photograph or record any damage and provide maintenance records, if relevant.

Dealing with insurance adjusters

Deal calmly and professionally with insurance adjusters. Remember, they are doing their job and it’s in everyone’s best interest to resolve issues efficiently and fairly.

Avoiding disputes with insurance company

The key to avoiding disputes is to understand your insurance policy thoroughly and to communicate clearly and honestly with your insurance provider.

Reducing Boat Engine Insurance Costs

Although boat engine insurance is a necessary expense, there are ways to lower your costs without compromising your coverage.

Tips for lower premiums

Shop around for the best insurance policy, consider a higher deductible to reduce your premiums, and always maintain your engine regularly.

Discounts for multiple policies

If you hold multiple policies with the same company—like home, auto, and boat—they may offer you a discount.

Seasonal savings

You may also be able to save money by opting for a seasonal policy if you only use your boat part of the year.

In conclusion, understanding, choosing, and managing your boat engine insurance are key steps in protecting your valuable investment and ensuring peace of mind as you enjoy many happy days on the water. Be diligent, be informed, and be safe, and you’ll be well on your way to a great boating experience.